Ancor Capital claims to offer trading opportunities on favorable terms. However, we believe it’s crucial to delve deeper and verify whether these claims hold true. In our experience, many fraudulent entities resort to such statements to lure unsuspecting traders. Therefore, we urge you to take five minutes of your time to read our review before considering opening an account.

- Ancor Capital General Information

- Registration and Client Portal Review

- Ancor Capital Trading Conditions

- Account Types Review

- Trading Platform

- Ancor Capital — Deposit and Withdrawal of Funds

- Verification

- Additional Options

- Is Ancor Capital a Scam?

- Legal Information and License

- Ancorc.com Domain Info

- Contacts Review

- More Details

- Pros and Cons

- Frequently Asked Questions (FAQ)

Ancor Capital General Information

| Website | https://ancorc.com/ |

| Phone Number | +48690908659 |

| support@ancrcap.com | |

| Address | — |

| License | — |

| Minimum Deposit | — |

| Assets | CFDs |

| Leverage | Up to 1:400 |

| Trading Platform | Unknown |

Registration and Client Portal Review

Our initial experience with the Ancor Capital website has left us somewhat underwhelmed. The design appears cluttered, making it a challenge for the eyes to find a focal point. Oddly enough, despite the abundance of information provided, a considerable portion of it appears to offer little practical utility. What stood out even more was the pervasive self-promotion that seemed to dominate the homepage, which, frankly, became quite tiresome to navigate through.

Regrettably, as we explored Ancor Capital’s website, we encountered difficulty in locating certain essential details about the company. This lack of transparency regarding vital information was disappointing and raised questions about the overall credibility and intentions of the broker. Given these initial impressions, we’re compelled to thoroughly review the broker’s offerings before considering any engagement.

The registration process at Ancor Capital follows a common sequence. You start by providing your personal information, selecting an account type, reviewing, and agreeing to the terms and conditions, and finally confirming your account. However, a notable drawback of this process is that it lacks the standard email and phone verification steps. These verification measures are commonly used in the industry to enhance security and validate user identities. The absence of these verification steps raises concerns about the broker’s commitment to maintaining a secure and reliable trading environment.

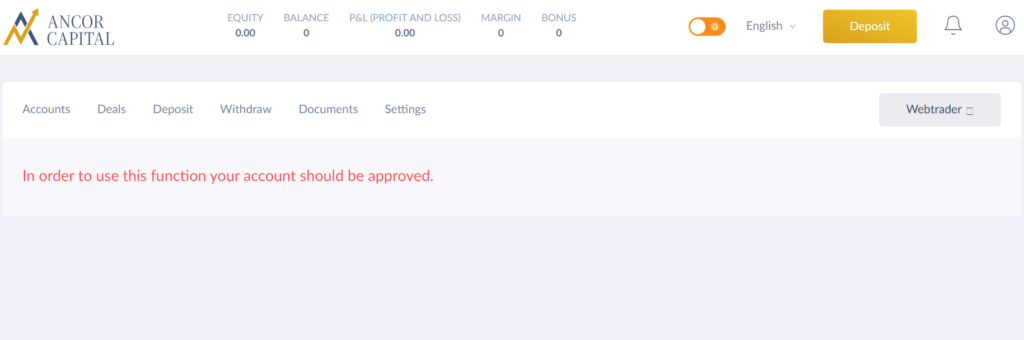

Upon gaining access to your Ancor Capital Client Portal, you will encounter a significant limitation – the inability to view any content within it until you complete the verification process. This setup, while intended to enhance security, unfortunately, results in a less than optimal user experience. The requirement to undergo verification before accessing essential features and information within the account can be seen as an unnecessary obstacle for traders.

Ancor Capital Trading Conditions

Gradually, we are moving towards the most intriguing part – the broker’s trading conditions. Let’s take a closer look to determine how truly favorable they are.

Account Types Review

Ancor Capital offers just three types of accounts: Silver, Gold, and Platinum. Interestingly, the broker doesn’t seem too eager to share detailed information about each account type. The descriptions lack any mention of the required minimum deposits for each tier. Furthermore, the accounts don’t significantly differ in terms of the services provided. The substantial differences appear mainly in the offered leverage and swap discount. Additionally, Platinum account holders gain access to webinars.

It’s worth noting that Ancor Capital boasts exceptionally high leverage for the European Economic Area, which immediately raises concerns about credibility. Unfortunately, spreads and commissions are left undisclosed. However, advanced charts are provided across all account types. In conclusion, it’s challenging to label these trading conditions as favorable. Based solely on its offerings, we find it hard to believe that Ancor Capital truly merits attention.

Trading Platform

Ancor Capital provides traders with the option to use either a downloadable trading terminal or a web-based trader for their trading activities. The downloadable trading terminal can be easily acquired directly from the broker’s official website. It is important to note that while this terminal is accessible, it doesn’t offer a particularly robust set of features or advanced functionalities that would make it stand out in the competitive trading platform landscape.

On the other hand, the web-based Ancor Capital platform is located within the personal account section of the website. However, access to the web trader is restricted and requires prior authentication before it can be utilized.

In terms of the trading terminal itself, its user interface and features may leave much to be desired. The design might be considered somewhat outdated, and the functionalities it offers may not match the standards set by more advanced trading platforms available in the market. Traders who are accustomed to more sophisticated tools and features may find the terminal lacking in terms of technical analysis tools, charting capabilities and real-time market data.

Ancor Capital — Deposit and Withdrawal of Funds

The company offers multiple methods for depositing funds into your trading account, including credit cards, bank transfers, and even electronic wallets. However, we encountered a somewhat perplexing issue when exploring the “Deposit” section. It seems that the broker has some unusual typos and employs a Cyrillic alphabet in certain places, which raises questions about professionalism and attention to detail.

When it comes to withdrawals, Ancor Capital claims to process them promptly. Unfortunately, the website lacks specific information regarding withdrawal timeframes. For withdrawing funds to a credit card, the company promises not to charge commissions.

Verification

Ancor Capital requires verification from its users. Upon completing the registration and gaining access to your personal account, you will be prompted to provide various documents to verify your identity. These documents include a valid government-issued photo ID, proof of address (like a utility bill or bank statement), and possibly the front and back sides of the credit card used for deposits (if applicable).

Ancor Capital will review documents and assess the information. The process usually takes several business days, during which the team will cross-reference the documents to ensure they match the information provided during registration.

Additional Options

Ancor Capital offers a few additional options for traders, including an analytics section on their official website. However, it’s worth noting that we are not entirely certain if you will find substantial and useful content there. Surprisingly, the broker doesn’t even provide online market forecasts in that section. Another feature they offer is a partner program, which allows individuals to become partners with the broker. However, it’s worth mentioning that the details of this program are not extensively described, and the exact amount of compensation remains undisclosed.

Is Ancor Capital a Scam?

We have strong suspicions that this broker is indeed a scam. However, if you still have doubts, we are prepared to demonstrate to you that your hopes for a successful partnership with Ancor Capital are misplaced.

Legal Information and License

Ancor Capital fails to disclose any information about its registration and operations jurisdiction, which is a violation of information disclosure laws. The website merely boasts a statement that it operates within the European Economic Area. However, this is baseless. In the European Economic Area, regulators do not allow such huge leverage. Moreover, they require brokers to be licensed. Yet, Ancor Capital does not possess any licenses. This company is operating unlawfully.

Ancorc.com Domain Info

Another reason why Ancor Capital seems like a scam is due to its short operational history. We had never come across such a broker before, and upon investigating the website’s domain registration, our suspicions were confirmed. In reality, the domain was only registered in April 2023. It’s worth noting that new brokers rarely inspire trust, as the overwhelming majority – around 95% – tend to be scams. Therefore, caution is advised when dealing with such new and unproven entities in the financial industry.

Contacts Review

The broker offers contact options such as email and a phone number for communication, yet their physical address remains undisclosed. However, it’s not surprising considering our findings that Ancor Capital is not registered as a legal entity anywhere. This lack of transparency in their registration status is quite consistent with the overall pattern we’ve observed.

More Details

Ancor Capital suggests clients download TeamViewer and AnyDesk. However, it’s important to note that these software programs have been associated with fraudulent activities. Scammers often exploit remote desktop software like TeamViewer and AnyDesk to gain unauthorized access to users’ computers and potentially steal personal information, funds, or compromise security. As a precautionary measure, it’s advised not to download or install such software from unverified sources, as they can pose significant risks to your privacy and security.

Pros and Cons

- None.

- Lack of official registration.

- Limited transparency.

- Suspicious software recommendations.

- No licenses.

- Shirt lifespan.

Frequently Asked Questions (FAQ)

Ancor Capital claims to offer trading services in the financial markets. However, due to the lack of transparency and credibility, it’s advisable to exercise caution before considering any engagement with this platform.

According to the trading conditions provided by Ancor Capital, the minimum deposit required for trading is not specified.

No, Ancor Capital is not a safe option for your funds. The broker’s lack of transparency, absence of regulatory information, and endorsement of suspicious software raise significant concerns about the safety and legitimacy of this platform.

The conditions are absurd.

Ancor Capital offers some bizarre conditions. Three tariff plans, but no mention of a minimum deposit, and the rest of the conditions are almost identical. Why offer such a thing? Is it an error from whoever designed the website or what? It strongly reeks of unprofessionalism and negligence. I’m also wondering if there’s a demo trading mode available here or not. Essentially, every broker should provide a demo mode; it’s a core service to allow newcomers to try the service without risking real money. But not here. It seems they couldn’t care less about a demo; they immediately ask you to invest real money, which I find unreasonable. The number of available assets is quite limited, and you also have to undergo verification right away, judging by what they write on the website: register – verify – trade. I didn’t find anything worthwhile here. It’s a too-good-to-be-true and unfamiliar broker with unreasonable conditions that you can’t test without risking real money. And I wouldn’t recommend doing that with Ancor Capital.

There's nothing good to say

I decided to try out Ancor Capital’s functionality out of curiosity, as they position themselves. However, I encountered numerous issues on their platform. Firstly, they don’t verify customer data at all. You can input fake email, name, surname, and phone number. No confirmations are sent to either email or phone. They also don’t request any documents during registration; the form is just a passageway for anyone to sign up. The only verification available is to upload a photo of a passport or driver’s license, but it’s not mandatory, and they don’t insist on it. Secondly, when it comes to depositing funds, they ask for deposits through some sketchy methods and even cryptocurrency. In short, upon closer inspection, this is all clearly a wild scam. Investing in anything here is not advisable; everything will be stolen.