Yet another forex broker claiming to have a real headquarters in the United Kingdom, but how many such have already been exposed? You’ve entered the Apsocial Finance review, where I’ll try to show and explain why this is a scammer, not a safe and verified platform for CFD trading using leverage. The firm clearly has numerous negative factors that definitively indicate illegal activity.

- Apsocial Finance General Information

- Is Apsocial Finance Broker a Safe Option for Traders?

- How Transparent Is Apsocial Finance Broker Regarding Regulations?

- Trading Conditions Breakdown: What to Expect?

- Platform Performance

- Does Apsocial Finance Provide Educational Tools for Traders?

- Hidden Fees and Charges: What Traders Need to Know?

- User Feedback: Insights from Existing Clients

- How Responsive Is Apsocial Finance Broker’s Customer Support Team in Resolving Issues?

- Pros and Cons

- Frequently Asked Questions (FAQ)

Apsocial Finance General Information

| Website | https://apsocialfinance.com/ |

| Phone Number | +61287664968 |

| support@apsocialfinance.net | |

| Address | Shepherdess Walk, London, N1 7LB – |

| License | — |

| Minimum Deposit | $10,000 |

| Assets | Cryptocurrencies, metals, forex, stocks, indices, commodities |

| Leverage | 1:200 |

| Trading Platform | WebTrader |

Is Apsocial Finance Broker a Safe Option for Traders?

After perusing the official website of the company, I’ve already made some notes for myself, such as the low transparency, absence of key data, and suspicious trading conditions. Well, I think the review of apsocialfinance.com will be interesting, as there’s much to discuss and unravel.

How Transparent Is Apsocial Finance Broker Regarding Regulations?

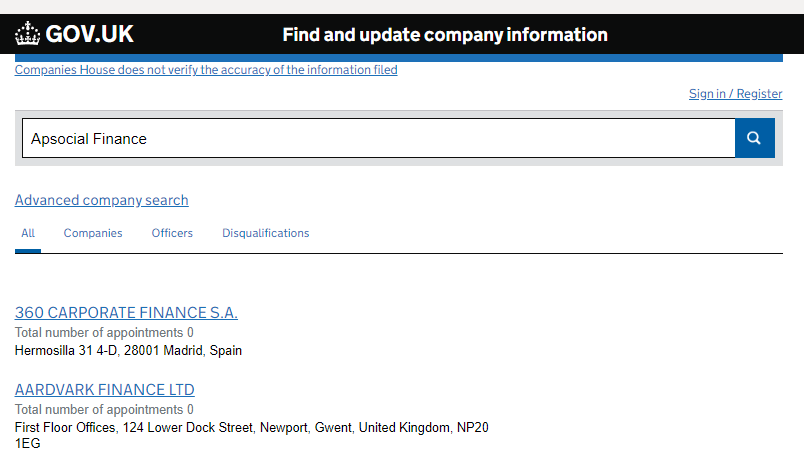

Let’s start with the key points of the firm. According to the address in the contact section, the organization is located in London, United Kingdom. However, for unknown reasons, it has not received a license from the British regulator, the Financial Conduct Authority (FCA), which oversees the activities of all brokerage intermediaries in this jurisdiction.

No information about oversight by financial commissions is found on the site. This alone is enough to understand, you are dealing with an illegal office operating without licenses. However, for greater certainty about the illegal activity, I will still try to check the FCA register. As expected, Apsocial Finance is not on the list of legal brokers.

It is quite strange to see a British company without an FCA license; perhaps it is not even registered in London? Fraudsters often display fake addresses of their offices to make potential clients think about the seriousness and solidity of the organization. Simply checking the legal entities register can reveal whether the platform is truly registered in the United Kingdom or if this is yet another lie to lure unsuspecting investors.

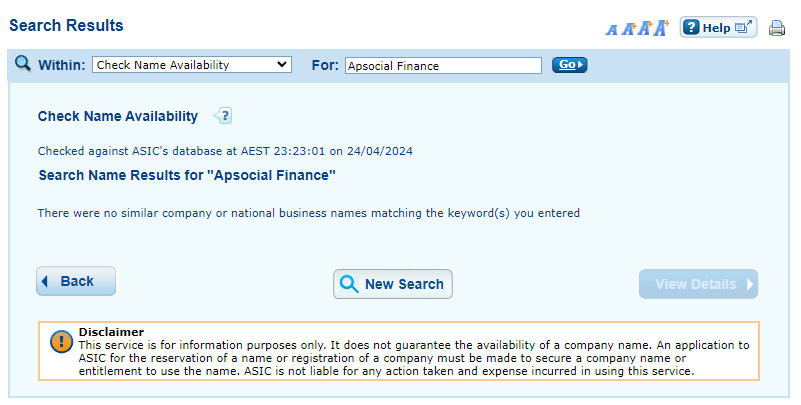

My suspicions about the fake address turned out to be accurate. The company truly does not appear in the registry of legal entities, which means it is not registered in the United Kingdom. You can look at the screenshot above and confirm — Apsocial Finance was not found. Where is the broker actually located? It’s unknown, but another clue is the phone number for contacting managers. +61287664968 is an Australian number. Could the office be under Australian jurisdiction? This would be indicated by the ASIC regulator, which oversees brokerage intermediaries there.

Indeed, there is no such firm in Australia either. I suspect the company is not registered at all and does not have a legal entity. Is it worth commenting on such a serious red flag, which is even worse than the lack of regulation?

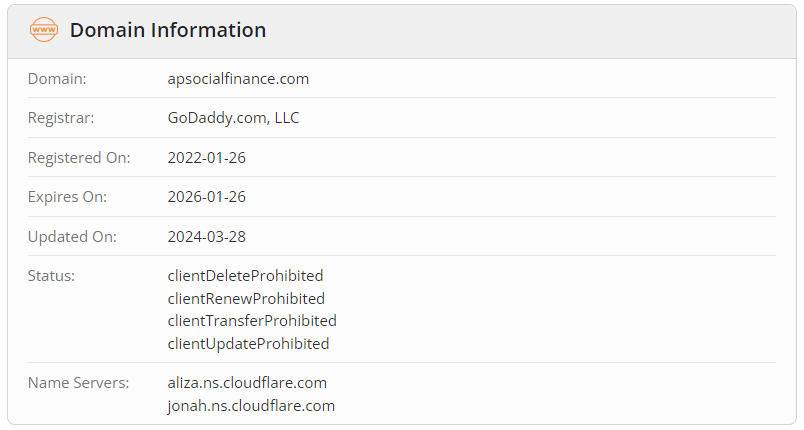

And the final point which should also be considered in this part of my Apsocial Finance review — the time of operation. It is no secret that the older a company is, the more experience it has and the more trust it garners. When was the platform founded? Good question, to which there is no answer on the website, but one can check when the website’s domain was registered. A special service indicated the domain appeared in 2022 and was last updated in 2024.

Do not assume that the company started operations in 2022. I sought help from another service — WebArchive, to look at snapshots that would indicate whether the platform existed before 2024. It turns out, in 2022 and 2023 the domain was up for sale. Marvelous! Without a website, an online broker could not operate, so I conclude the platform only began serving clients in 2024. Is it necessary to say it is an extremely short period of operation? It is simply impossible to create a reputation as a safe and verified intermediary in just a few months.

Thus, short operating time, lack of a license, fake address, and no legal entity. With that, the first part of the review of apsocialfinance.com is concluded.

Trading Conditions Breakdown: What to Expect?

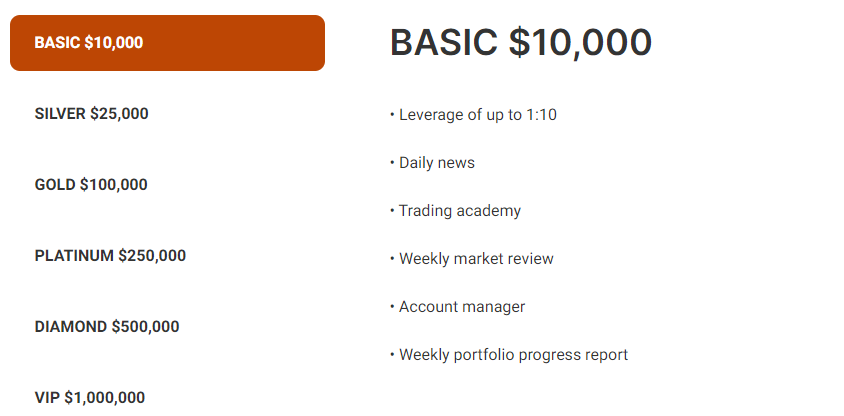

Looking at the trading conditions, it’s hard to believe that the platform is profitable and comfortable for trading. For example, consider the minimum deposit size. To open the first tariff plan, you need to have at least $10,000. Seriously? Who would be willing to risk such a serious amount when other companies start from $100? The difference between $100 and $10,000 is colossal, but agree, losing $100 versus $10,000 feels completely different.

Moreover, Apsocial Finance does not offer a demo account, so such a high initial deposit looks even more ludicrous. Are you ready to invest $10,000 just to test the service? Why doesn’t the firm provide virtual funds for training?

The maximum leverage of 1:200 represents huge risks. Such leverage is prohibited by financial commissions, which again proves the lack of regulation. Obviously, the fraudsters didn’t just set a high minimum threshold and offered a huge minimum deposit for no reason; they understand that these are huge risks for traders.

The better the account type, the more additional services — blatant extortion by the firm. Scammers artificially impose restrictions on the minimum packages to motivate users to invest more money.

And the last point that is important to mention here is commissions and spreads. Apsocial Finance does not specify the size of commissions and spreads, which are key parameters of trading conditions. There is no doubt, it is a dealing desk that earns not through commissions but through client deposits. All deposits that come into the balance, essentially belong to the firm, and that is its revenue. Why should traders invest in such an obvious trap?

Platform Performance

To see what the platform looks like, you simply need to register an account. And right away, it turns out that the terminal is not MetaTrader 4, as stated on the homepage. It appears Apsocial Finance deceives users by indicating MetaTrader 4 software, while in reality, it offers a different platform. Instead of a standard terminal, the company offers some poor parody.

This platform does not have mobile versions, meaning you cannot download apps from the official AppStore and Play Market; they simply aren’t there. Perhaps the terminal is adapted for mobile browsers, but this is not equivalent to a full-fledged mobile application. The same applies to the desktop version. It is absent, with only a web-version available, which is unlikely to adequately replace a desktop setup.

A quick look at the platform makes it clear — the functionality is severely lacking. Clients have access to only basic options, such as pending orders, drawing tools, indicators, various timeframes, and detailed asset information. And that’s it? Where are the advisors for auto-trading? Is it possible to copy trades? How can one save platform settings for further use using templates?

In short, a terrible and minimally functional parody of a trading platform. Only a web-version, limited capabilities, and blatant lying on the part of the company. Are there still doubts about the honesty of the company?

Does Apsocial Finance Provide Educational Tools for Traders?

The firm promises to provide 24/5 technical support and analytical resources, as stated on the homepage of the website. The following services are also included in the first tariff:

- Daily news.

- Trading academy.

- Market review.

- Account manager.

- Weekly portfolio progress report.

However, there is no guarantee that all the listed options are provided to clients. This could just be a bait to make traders deposit funds. Moreover, assessing the quality of these services is not possible since they are not freely accessible. If they are of low quality, they will be of no use, but rather the opposite. The client will use analytics and consultations from the manager of Apsocial Finance and thus lose money in trading. Educational materials from the academy may be misleading, and daily news may clutter the trader’s focus and attention.

Hidden Fees and Charges: What Traders Need to Know?

Commissions for trading are unknown, but most likely there are none, as the company operates as a dealing desk, profiting from its clients’ losses, so charging a commission and a high spread makes no sense for them. Also, charges for financial transactions are not specified. Is there a fee for depositing and withdrawing funds? It’s treated like a secret, as if knowing this is prohibited. Yet all traders understand that a verified broker will disclose and explain the commissions on the platform.

User Feedback: Insights from Existing Clients

As this is a young platform, reviews of Apsocial Finance are almost nonexistent online. A few positive comments and articles about the company can be noticed, but these are clearly commissioned materials.

It is very easy to recognize that the comments are fake, for example, by how the authors write about the platform, calling it MetaTrader 4, though it’s a completely different terminal. Or suddenly an author might claim that the broker operates on an STP or ECN business model, even though it is just a typical dealing desk.

How Responsive Is Apsocial Finance Broker’s Customer Support Team in Resolving Issues?

As I mentioned earlier, the phone number is oddly Australian, not British, and no such firm exists in Australia. Additionally, the company provided an email address that checks out as real, but I doubt there’s any point in writing there. It is also unlikely you’ll get a response through the feedback form available in the “contacts” section on the website. No online chat has been set up, though it would save on staff costs and provide a quick way to communicate with clients who prefer not to use the phone or wait for an email response.

Another similar broker that you can read about is zinzenova.com review.

Pros and Cons

- The firm only started operating in 2024.

- The address in the United Kingdom is fake.

- Illegal activity.

- Lack of regulation.

- Business model with a conflict of interest.

- Few reviews online.

Frequently Asked Questions (FAQ)

This brokerage firm offers to trade CFDs using leverage on a web platform. Additionally, supplementary services are provided.

According to the account types description, clients need to have at least $10,000 to start trading here. This amount is required to activate the first tariff plan.

A company with a fake address on the site and absence from all legal registries cannot be safe. Therefore, it is a risky place where there is a high probability of a scam.

They want to scam you out of your money

Just another scam broker. The FCA license isn’t mentioned on the site, so the office in London is 100% fake. I don’t even need to check the registries; I can see it’s fraud. Moreover, they ask for at least $10k as a minimum deposit. That’s a huge amount. And should I mention it’s 100% a B-Book? Overall, don’t believe the fraudsters. They want to deceive you!

An unfortunate situation, $15,000 at stake

You can believe me, I got scammed out of my money. I believed in the positive reviews of Apsocial Finance and transferred $15,000 there. I feel so foolish; I can’t believe I fell for it. I trusted some anonymous scammers, and it turned out to be a fake platform with no license, no official registration, and no signs of reliability.

My $15,000 went to some fraudsters. I don’t know who they are. They won’t get in touch. I’ve sent 20 emails to their address, and left 10 messages via their special form, but all to no avail. They completely ignore me. I don’t know how to influence the fraudsters to at least send some money back. I feel terrible. This is a horrible experience. Don’t trust positive reviews and articles online about this fraud. Scammers specifically lure you in with fake promises.