Fraudsters regularly create projects disguised as brokerage firms. In this Domking Capital LTD review, we examine yet another such “masterpiece.” As usual, it modestly calls itself the “№1 broker on the market” and promises clients seamless trading, honest payouts, and 24/7 support. However, it failed to completely hide its differences from a regulated company. We will show you how to recognize this scam and why you should not send them your money.

- Domking Capital LTD General Information

- Registration and Client Portal Review

- Account Types Review

- Trading Platform

- Domking Capital LTD — Deposit and Withdrawal of Funds

- Verification

- Additional Options

- Is Domking Capital LTD a Scam?

- Legal Information and License

- Domking Capital LTD Domain Info

- Contacts Review

- Pros and Cons

- Frequently Asked Questions (FAQ)

Domking Capital LTD General Information

| Website | https://domkingcapitalltd.com/ |

| Phone Number | +6531065144 |

| support@domking-capital.com | |

| Address | 4 LENG KEE RD #03-12 SIS BUILDING, SINGAPORE, 159088 |

| License | None |

| Minimum Deposit | €100 |

| Assets | CFDs |

| Leverage | Up to 1:100 |

| Trading Platform | Webtrader |

Registration and Client Portal Review

For some reason, we assumed that a Forex/CFD broker’s information resource should look different from the official website of Domking Capital LTD. What struck us most was that the company only has six pages on its website. Either they lacked the content, or the developers were unable (or too lazy) to provide traders with more useful information. As a result, the website contains almost no relevant details.

- The Markets section does not even list the available markets, let alone provide asset specifications. A widget displaying the current situation for popular trading instruments is hardly a full-fledged substitute for this information. Moreover, there is no guarantee that the prices from TradingView, which are streamed into this table, are accurate.

- The only documents available on the website are the User Agreement and Refund Policy. The project’s owners seem unaware that regulatory standards typically require the inclusion of Privacy, KYC, AML Policies, and a detailed risk disclosure.

- Domking Capital LTD also refuses to provide detailed information about its trading platform, payment methods, fees, or commissions. It seems that the broker has no intention of sharing important details about itself or its services with website visitors. Instead, it appears to rely on other methods to attract clients.

The company not only has content issues but also technical problems with its website. To create an account with the broker, users must fill out a registration form, entering:

- First and last name.

- Email address and phone number.

- Password (twice).

There is also a Promo Code field, but it is unclear whether filling it out is mandatory. To complete the process, users must agree to the User Agreement and Refund Policy and submit their data.

At first glance, this process seems simple, but opening an account independently is impossible. Submitting the form results in a “Registration not allowed” message, regardless of the applicant’s country of residence.

Perhaps we simply did not select the correct geolocation. However, we suspect that obtaining an active account is only possible after contacting customer support. This is a common trick scammers use to filter out unwanted clients, allowing only inexperienced traders — who have little knowledge of financial markets — to register.

Naturally, we were also unable to access the personal account area. However, it is unlikely that this broker offers any unique features for managing profiles and trading accounts. Most likely, they are using a generic template with only the bare minimum of functionality.

Account Types Review

Traders looking to explore Domking Capital LTD’s trading conditions will be deeply disappointed. As we already mentioned, the company does not publish contract specifications. It also keeps most general trade characteristics secret. We tried to extract as much information as possible from the account types table, but details remain scarce.

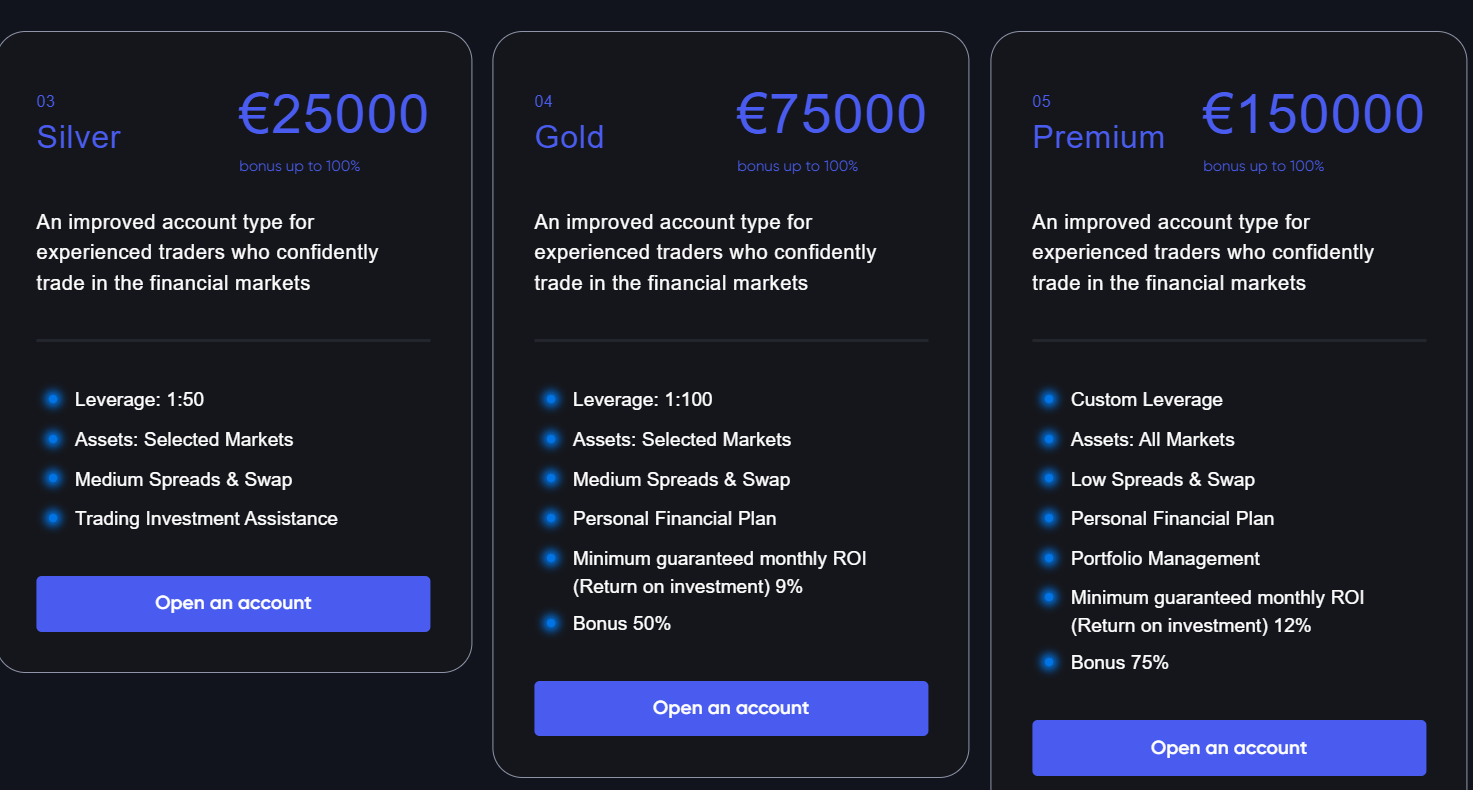

The broker offers a total of seven account types:

- Intro — Minimum deposit: €100, maximum leverage: 1:10.

- Beginner — Minimum deposit: €5,000, maximum leverage: 1:20.

- Silver — Minimum deposit: €25,000, maximum leverage: 1:50.

- Gold — Minimum deposit: €75,000, maximum leverage: 1:100.

- Premium — Minimum deposit: €150,000.

- VIP — Minimum deposit: €250,000.

- Partners — Minimum deposit: €1,000,000.

Important Note! Holders of the last three account types can negotiate their maximum leverage with company representatives.

In general, the company provides potential clients with only the minimum deposit requirement and maximum leverage (which is most likely applicable only to forex pairs). From our perspective, this information is insufficient for traders to make an informed decision. However, most beginners in the market tend to focus solely on the amount they are willing to invest, and the platform seems to be targeting this category of users.

We have identified several problems with the broker’s account offerings:

- Lack of transparency on trading costs — There are no details on spreads, swaps (except for vague descriptions like “Medium” or “Low”), or trading commissions. This means traders cannot accurately estimate their trading costs before opening an account.

- Higher leverage for larger accounts — As account tiers increase, the leverage does as well. This significantly raises trading risks, making it easier for clients to lose large amounts — even their entire deposit. This is a classic scam tactic: clients with substantial balances are encouraged to lose money quickly, maximizing the broker’s profits.

- Bonus traps — Accounts starting from Gold receive bonuses ranging from 50% to 100%. However, the company does not have a Bonus Policy as a separate document — some conditions are vaguely mentioned in the User Agreement. Upon closer inspection, it becomes clear that while the bonus is active, funds cannot be withdrawn. This is a clear attempt to keep large sums locked in accounts until they are eventually lost. The so-called “wagering requirements” force traders to increase trading volume, which is why reputable regulators prohibit such promotions. For Domking Capital LTD, however, these restrictions mean nothing.

- Deposit interest rates (Ponzi scheme alert) — Starting from Gold, the broker offers deposit interest rates between 9% and 18%. We highly doubt that Domking Capital LTD is altruistic enough to share its profits with clients. Instead, a more logical explanation is that these payouts come from the deposits of other users, which the company freely manipulates. This strongly suggests that funds are not held in segregated accounts, making safe storage of capital nothing more than a myth.

On top of this, the broker also promises education for beginners and “personal assistance” in trading — another set of classic scam techniques. The goal is to entice users, get them to deposit as much as possible, and keep their money locked in for as long as possible. Eventually, the client will either lose their funds on their own or be “helped” by company managers.

Trading Platform

Since we were unable to register an account, we could not test Domking Capital LTD’s trading platform. As a result, traders will have to explore its features, strengths, and weaknesses on their own.

One major issue is that the company does not offer a demo account, forcing traders to learn by risking real money. Scammers rarely provide demo accounts, as they see it as an unnecessary obstacle to increasing trader losses (and their own profits).

Additionally, we have an important question for the company: Why didn’t they opt for established, industry-leading platforms like MetaTrader, cTrader, or TradingView? Do they believe their web-based terminal is superior? Or is it simply because they cannot acquire high-quality trading software due to their lack of proper licensing?

Either way, it raises serious concerns about the legitimacy and reliability of Domking Capital LTD.

Domking Capital LTD — Deposit and Withdrawal of Funds

The company’s website provides no information about the available payment methods. They can only be seen inside the personal account, but since we were unable to register, we still lack access to this section.

However, we can already identify several problems regarding payments, even without seeing the full picture:

- No disclosed banking details — As we mentioned earlier, Domking Capital LTD does not publish its payment details. This is likely done to evade financial regulators and tax authorities. The only way to determine who actually receives traders’ deposits would be through an official investigation.

- Lack of transparency on non-trading fees — The company does not disclose any fees for deposits or withdrawals. There is also no information on limits or processing times. The only mention in the broker’s legal documents states that traders must resolve all payment issues on their own.

- Mandatory verification for withdrawals — The Refund Policy states that identity verification is required before processing withdrawal requests.

Verification

Interestingly, Domking Capital LTD’s legal documents do not specify any mandatory verification requirements for client registration. This makes sense considering that the company does not have KYC or AML policies. However, the Refund Policy mentions document checks for withdrawals, suggesting that verification functions may exist inside the client dashboard. If this is the case, collecting client documents could be considered illegal, as the company does not operate under proper regulatory guidelines.

Additional Options

Domking Capital LTD does not offer any additional services to its clients. The broker lacks even basic industry-standard features, such as:

- Educational materials.

- Market analysis and research.

- Affiliate programs.

Although some of these services are listed in the account types table, we are confident they are not actually implemented. This is a typical scam tactic — promising traders various benefits but failing to deliver even 10% of what was advertised.

Is Domking Capital LTD a Scam?

At this point, there is no doubt that Domking Capital LTD is a fraudulent scheme. A deeper investigation into the company’s legal information and licensing should provide even more direct proof.

Legal Information and License

The broker remains silent about its official registration details and whether it holds any valid financial licenses. However, the company does mention an address (although without specifying the city), clearly expecting users to search for the firm’s name.

Upon investigation, it turns out that this address is linked to Singapore. A further search in the Singaporean corporate registry reveals a company named Domking Capital Management PTE LTD, which even holds a valid MAS (Monetary Authority of Singapore) license for fund management.

We conducted this verification ourselves and confirmed that Domking Capital Management PTE LTD is indeed registered with ACRA (Accounting and Corporate Regulatory Authority of Singapore). The firm has an active MAS license, which legally allows it to manage investment funds in Singapore’s stock market.

However, does this mean that Domking Capital LTD is the same as Domking Capital Management PTE LTD? That’s a completely different question — one that traders should carefully consider before depositing funds with this broker.

Domking Capital LTD Domain Info

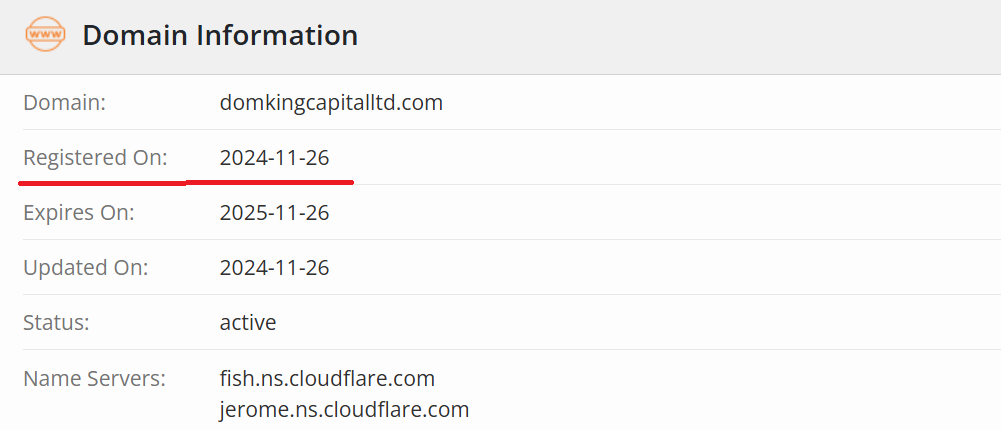

The broker claims to have been founded in 2015 and to have entered the international market in 2017. If this were true, such an experience would deserve some respect. However, we have already established that the platform’s claims cannot be trusted. To determine the company’s real age, we checked its domain registration date using a WHOIS lookup.

According to WHOIS records, the domain domkingcapitalltd.com was registered only in late November 2024. This means the project is just about 3.5 months old. The story about existing for 10 years and operating internationally for 8 years did not pass even the simplest verification.

Contacts Review

On the broker’s contact page, users will find:

- An email address for support.

- A phone number with a Singapore country code.

- A Singapore-based address.

There is also a “contact form”, which supposedly allows users to ask any question and receive a response within 24 hours. However, the form only includes fields for entering a name and phone number, without any option to type a message.

The company does not provide links to any social media pages, likely because they never bothered to create them. After all, why waste time and money on maintaining social media when the project won’t last long? Even the owners of Domking Capital LTD probably don’t believe it will survive for more than six months.

Pros and Cons

- Decent website design.

- Low minimum deposit of €100, accessible to most traders.

- No official registration — failed attempt to impersonate a real Singaporean firm.

- No license or regulation — falsely using an unrelated company’s license.

- Fake company history — misleading claims about its founding year.

- Lack of trading condition details — no spreads, commissions, or swap rates disclosed.

- Cannot register a new account without contacting support.

Frequently Asked Questions (FAQ)

The scam broker claims to offer trading in forex pairs and CFDs. However, this virtual platform cannot provide real market access — it simply collects client deposits.

The minimum deposit is €100, but we are convinced that the scammers will steal any amount, even as small as this. We strongly recommend avoiding deposits on this fake platform.

No. This unregistered and unlicensed entity offers no security for client funds. There are zero guarantees regarding the safety of deposits or the legitimacy of financial transactions.

Hoping to get at least some of my money back

From the very beginning, Domking Capital Ltd’s managers assured me that there would be no problems withdrawing funds. I decided to give it a try, thinking maybe I could actually make money. At first, everything looked great: trades were active, my balance grew, managers were always in touch, and support responded quickly.

Don’t make the same mistake I did!

Do not fall for the sweet promises of these scammers! They told me about great trading conditions, expert support, and fast withdrawals. In reality, it was all lies!