How about reading a review of Quanta Finance AI — Swiss pioneer in the field of Quantum computing & AI? We have not encountered such brokers yet. Let’s quickly see what innovative things they offer to clients. Maybe everything is not as wonderful as advertised? What if there is a scam behind this platform?

- Quanta Finance AI General Information

- Registration and Client Portal Review

- Quanta Finance AI Trading Conditions

- Account Types Review

- Trading Platform

- Quanta Finance AI — Deposit and Withdrawal of Funds

- Verification

- Additional Options

- Is Quanta Finance AI a Scam?

- Legal Information and License

- Quantafxai.io Domain Info

- Contacts Review

- Pros and Cons

- Frequently Asked Questions (FAQ)

Quanta Finance AI General Information

| Website | https://quantafxai.io/ |

| Phone Number | — |

| Support@quantafxai.io | |

| Address | Trader United Kingdom branch in London, 16-18 Monument St, EC3R 8AJ, United Kingdom |

| License | — |

| Minimum Deposit | $5,000 |

| Assets | CFDs, crypto |

| Leverage | — |

| Trading Platform | WebTrader |

Registration and Client Portal Review

The official website of Quanta Finance AI looks quite attractive. A bright and intense shade of blue was used for the design, but that’s probably its only real advantage in our opinion. The main issue is that the website is completely uninformative and poorly structured.

Another problem is that it is available only in English. A broker that claims to be global and at least of Swiss origin simply cannot offer just one language option. This clearly indicates cost-cutting on website development. Moreover, it’s obvious that amateurs were behind this project, as the content is full of inconsistencies. It feels like the platform was assembled in a Brothers Grimm fashion — taking bits and pieces from different sources and patching them together.

Perhaps the only genuinely noteworthy feature is the small icon in the left corner that allows users to adjust the text for better readability. That is actually useful. But the vague and meaningless statements about the “dynamic world of CFD”? Not so much.

At first glance, the registration process seems simple. You only need to fill out a short form with your contact details — your name, email address, phone number, and a password of your choice.

However, don’t get your hopes up. Like many things on this website, the registration form is nothing more than a placeholder. As soon as you complete the form and click the button, you’ll get a message saying that the page has expired and needs to be refreshed. Even after refreshing and re-entering your details, nothing will happen — you’ll encounter the same error again.

Meanwhile, we have no doubt that your personal information, including your phone number, has already been collected by the creators of this platform. What happens next is entirely up to them — whether they decide to contact you and explain how to “properly” register or simply deny you access to this so-called “exclusive” platform.

Quanta Finance AI Trading Conditions

Let’s take a closer look at what this broker actually offers in its trading conditions.

Account Types Review

To be honest, the selection is extremely limited — only three account types. There’s no demo account, which is already a red flag. The broker claims to use artificial intelligence, yet none of the available plans mention AI at all. This means that either their AI technology is just a marketing gimmick, or it’s only available to a select few — so clients shouldn’t count on it.

Now, let’s break down the accounts:

- Basic ($5,000) — For this price, you only get access to three cryptocurrency exchanges. No portfolio management, barely any functionality. This doesn’t even come close to serious trading conditions.

- Silver ($25,000) — Adds a few extra features: 50 trades per month, portfolio management, and access to five exchanges. But still, there’s no sign of any real trading advantages.

- VIP ($100,000) — Offers 100 trades per month, more exchanges, and even a personal manager.

The most alarming part? The broker claims to specialize in CFD trading, yet the account descriptions don’t mention CFDs at all. No leverage details, no risk disclosures, nothing about execution types. Instead, the so-called trading conditions seem vague and impractical.

So, what exactly is being offered here? Access to exchanges? Arbitrage? Some kind of portfolio tracking? The services seem deliberately unclear, making it impossible to understand what clients are actually paying for.

Trading Platform

The platform of the broker Quanta Finance AI is still a complete mystery. There’s absolutely no information about it. Even if they provide pure arbitrage, there still has to be a platform where data is collected. But no, based on the services they offer, they even promise the ability to keep open orders. The only thing we can say for sure is that the platform is probably proprietary because there are no known industry terminals for arbitrage yet.

Moreover, it is most likely unlicensed. This suggests that the platform is not subject to any regulatory authority or oversight. There’s also a high chance that the platform is manipulable, which only adds to the risks. In short, everything about it seems shady and unreliable.

Quanta Finance AI — Deposit and Withdrawal of Funds

So, how are we supposed to deposit these $5,000 into the account? Who knows. The problem is, they don’t give us any hints. Alright, maybe they use cryptocurrency, but you know what’s the most interesting part?

Here’s what they wrote:

- You agree to pay all fees and charges associated with your transactions, including but not limited to spreads, commissions, overnight financing fees, and any other applicable charges.

- All fees and charges will be deducted from your account.

- We reserve the right to change our fees and charges at any time. Any changes will be communicated to you in advance.

Hey, guys, at least let us know how much these fees are. What if they’re $100 per lot? Meanwhile, no, that’s a secret too. Just like how long it will take them to process your withdrawal requests.

Yeah, this is definitely not a Swiss approach to business. More like the “we’ll keep you guessing” or “hope you don’t notice” method.

Verification

At the same time, these guys claim that without completing KYC, you won’t get full access to their services. The standard procedure usually involves submitting personal identification documents, proof of address, and sometimes even a selfie to verify your identity.

Now, sharing sensitive information like that with such a broker, or whatever they are, an arbitrage service — is something you’d have to be really cautious about. It’s not exactly the kind of company you’d trust with your personal data, given how dubious everything about them looks.

Additional Options

As for the additional services, it seems they offer some kind of education. In their menu, there’s a section that includes blocks like trading strategies, market analysis, forex and CFD trading, and risk management. However, these are not serious educational resources. Each of these topics is crammed into a single page, attempting to cover as much as possible in the least amount of space.

For example, they’ve briefly described trading strategies, but even within that, they haven’t covered anything in depth. And, of course, they didn’t include all the strategies — just a few scattered ideas. The value of this “education” is essentially zero. It’s all very superficial, offering general information that’s completely unhelpful for actual traders looking to learn something useful.

The same thing applies to the other sections. It’s more like an attempt to give the illusion of value while offering nothing of substance. It’s a waste of time and just a way to confuse potential users.

Is Quanta Finance AI a Scam?

It’s hard to even understand why this broker has given itself such grand titles or called itself Swiss quality. In fact, it’s just a hollow shell. Let’s take a closer look.

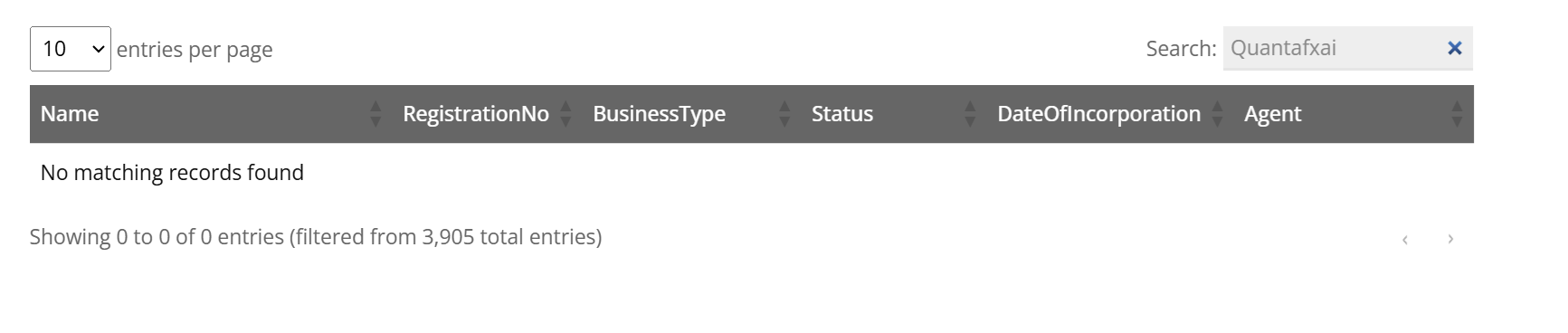

Legal Information and License

On the pages of the website, the company plays a game of “name as many countries as possible.” In their contact section, they list the UK and Canada, but in the user agreement, they claim to operate under the jurisdiction of the Netherlands and are supposedly regulated by the SVGFSA (Saint Vincent and the Grenadines Financial Services Authority). None of this information is true. Quantafxai LLC isn’t registered in any of the countries they list, and it doesn’t have a license in any of those places. Not even in the offshore territories like Saint Vincent and the Grenadines or the Grenadines. It’s all just a fabrication.

Logically, it all adds up to one big red flag. This so-called broker is nothing more than a collection of fabricated claims designed to give the illusion of legitimacy.

Quantafxai.io Domain Info

According to the Whois service, the domain was registered in August 2024, and it was last updated in January 2025. Based on reviews and feedback, it appears that the company really started operating only around that time.

In fact, its actual operating time is barely a few months. It’s difficult to trust a company that’s so new, especially one that hasn’t built any real history or track record.

We have seen many similar newly created websites of CFD brokers claiming to have been in the trading market for many years. For example, turfcapprivate.com (Turf Capital Private LTD) – you can read our review here, or Capital Systematics (capitalsystematic.org), which we covered here. They were launched a few month ago. Quanta Finance AI follows the same path as these so-called brokers. We hope you recognize this pattern and learn to distinguish long-established companies from those merely pretending to be one.

Contacts Review

They offer an email address as their primary contact method and list two office locations on their website. However, when you try to look these offices up on the map, it becomes immediately clear that they have nothing to do with the Quanta Finance AI broker at all. If you search for the addresses they provide, you won’t find any broker’s office or even anything remotely related to this company.

Instead, all you’ll find are either empty buildings or unrelated businesses. It’s as if they’ve picked random addresses and slapped them onto their website.

Pros and Cons

- The website is fairly easy to navigate.

- There’s very little actual information available about the company, its operations, or its regulatory standing.

- The provided contact methods, including an email address and two office locations, are dubious.

- The company is not licensed or regulated in any of the countries it claims to operate in.

- The platform only started functioning in early 2025, with the domain registered in August 2024.

- The platform promotes high returns and arbitrage opportunities, but without providing solid proof or transparent information.

Frequently Asked Questions (FAQ)

Who knows what exactly they offer. It’s unclear whether they are focused on trading or arbitrage.

According to the trading terms, the minimum deposit required to start trading is $5,000.

No, it is not safe. The platform is unlicensed.

Registration is impossible, and customer support is ignoring me - do they even operate?

I can’t even register with them. How do people do anything here? I tried different data, devices, IPs, emails, and so on – but nothing works. I emailed them, and enough time has passed, but I still haven’t received a reply. Am I being ignored, or do they not even operate? Either way, this is all fluff, and something like this should not be happening with a reliable and professional project. Don’t waste your time here. Don’t bother with these scammers.