Today, the subject of our review is yet another scam broker, Lincoln Financial Service LTD. The project creators are ready to fulfill all users’ dreams: provide access to 350+ assets, offer competitive spreads, and address any issues 24/5. Nevertheless, all these “perks” exist only in the virtual space and, perhaps, in the minds of the company’s trusting clients. It’s very easy to verify if this company is a scam.

- Lincoln Financial Service LTD General Information

- Registration and Client Portal Review

- Lincoln Financial Service LTD Trading Conditions

- Account Types Review

- Trading Platform

- Lincoln Financial Service LTD — Deposit and Withdrawal of Funds

- Verification

- Additional Options

- Is Lincoln Financial Service LTD a Scam?

- Legal Information and License

- Lincolnfinancialservicesltd.vip Domain Info

- Contacts Review

- Pros and Cons

- Frequently Asked Questions (FAQ)

Lincoln Financial Service LTD General Information

| Website | https://www.lincolnfinancialservicesltd.com/, https://www.lincolnfinancialservicesltd.vip/ |

| Phone Number | +48608188401 |

| support@lincolnfinancialservicesltd.net | |

| Address | Sweetwood Drive Street, Boulder, Colorado, USA, 80302 |

| License | — |

| Minimum Deposit | $100 |

| Assets | CFDs |

| Leverage | Up to 1:400 |

| Trading Platform | WebTrader |

Registration and Client Portal Review

It seems that the developers of the official website were in a hurry to start collecting funds from clients. As a result, instead of a solid informational resource, what every visitor sees is something that’s challenging to even name.

It’s hard not to refer to this content heap, where the eye stumbles upon something on practically every page, in almost every information block, as the broker’s website. The risk disclaimer in the footer appears to be borrowed either from a broker dealing in futures options or even from a binary options provider. In either case, it’s entirely unsuitable for a CFD contract trading service.

We can continue to talk about the “genius” of the Lincoln Financial Service LTD developers by mentioning, for instance, their incredibly fortunate choice of colors, where small gray and dark-blue inscriptions of any size become indistinguishable against a black background. In short, the website left us disappointed.

Even in a simple registration form, which in our opinion should be foolproof, the “experts” managed to find a way to create a “masterpiece.” There are simply no other words for the list for selecting an account type. Not only do the account types in this list have little in common with those listed in the table on the homepage and the corresponding special page. However, there are even fewer of them – not 5, as they tell website visitors, but 4.

After such a surprise from Lincoln Financial Service LTD, a potential client is unlikely to notice that during the registration process, no confirmation of either a phone number or an email address was required from them. In other words, security, as promised by the creators, is at a high level.

Furthermore, we discovered that a registered client can access any information in their Client Portal and perform various operations, both trading and non-trading, until they initiate a withdrawal request, without completing the verification process.

Such an approach is quite typical for pseudo-brokers who are solely concerned with inbound cash flow. It’s entirely logical that they don’t prioritize the security of client funds.

Lincoln Financial Service LTD Trading Conditions

Let’s delve into the main strengths of this broker, namely its trading conditions. Who knows, they might turn out to be weaknesses.

Account Types Review

The broker has an initial deposit requirement of $100. Interestingly, they don’t provide clear information about details like the size of spreads and trading commissions. The range of additional services you can access as a client largely depends on the specific account plan you choose. There are five distinct plans available, and let’s take a closer look at each of them.

The beginner package appears to target novice traders. It offers a limited selection of assets, dedicated account manager support, and the inclusion of 3 insured trades. The reason for this constrained asset availability remains unclear.

Silver account options don’t differ significantly from the first one, except for the addition of company lending and a wider range of trading instruments. However, to activate this plan, a minimum deposit of $5,000 is required.

The remaining plans demand even more substantial deposits and promise vague additional services such as mentorship programs, trading signals, dedicated analysts, and insurance. The trading conditions offered by Lincoln Financial Service LTD are not transparent and seem oddly similar across these plans. A comprehensive list of services only becomes available with a deposit of $100,000, or more.

The question arises: why would any prudent trader entrust such a significant amount of capital to a faceless company with no established reputation?

Trading Platform

The trading platform provided by Lincoln Financial Service LTD operates in two versions: a web trader and a mobile trader. Interestingly, the mobile terminal functions as a web platform as well, without the availability of a standalone application that can be downloaded from official app stores like AppStore and Play Market.

However, it’s important to note that the trading platform falls short in terms of functionality and capabilities, which may disappoint professional traders. Notably, it lacks features like the ability to upload custom indicators, auto-trading, copy-trading, and sophisticated indicators.

Lincoln Financial Service LTD — Deposit and Withdrawal of Funds

The listed deposit methods include credit/debit cards and bank transfers. However, we have our reservations regarding the accuracy of these options. When we accessed the personal account and attempted to fund the account, we were informed that the company would get in touch with us to confirm the payment details.

Verification

After registering your account, you may need to undergo a verification process. This process typically involves the following steps:

- The broker may require you to submit certain documents to verify your identity and address. These documents commonly include a government-issued ID (passport or driver’s license), proof of address (utility bill or bank statement), and any other documentation requested by the broker.

- You’ll need to upload clear and legible copies of the required documents through the broker’s platform. Some brokers provide a secure document upload feature within your account dashboard.

- The broker’s compliance team will review the documents you’ve submitted. This process may take some time, depending on the broker’s policies.

It’s important to note that the verification process may vary between brokers, and Lincoln Financial Service LTD may have its specific requirements. Always refer to the broker’s guidelines and instructions for the most accurate information regarding the verification process.

Additional Options

In the case of Lincoln Financial Service LTD, their additional options encompass a wide range of features and services, including insured trades, deposit bonuses, a personal account manager, trading signals, and more. Let’s delve into what these entail:

- Insured Trades. This feature may suggest that the broker is not likely routing your orders to the interbank market. It’s essential to be aware that such insurance often comes with conditions and terms that may affect your trading strategies.

- Deposit Bonuses. Bonuses on deposits are commonly offered by brokers, but they typically come with conditions for trading volume requirements before you can withdraw the bonus funds.

- Personal Account Manager. Having a personal account manager can be helpful for some traders, but it’s crucial to recognize that their qualifications and expertise may vary. Trusting their guidance entirely can be risky, and it’s advisable to conduct independent research.

- Trading Signals. The reliability of trading signals and analysis provided by the broker can be a point of contention. It’s unclear what qualifications the staff possesses, and whether their forecasts can be trusted is uncertain.

When considering these additional options, it’s essential for traders to exercise caution, thoroughly understand the terms and conditions associated with them, and not rely solely on them for making trading decisions.

Is Lincoln Financial Service LTD a Scam?

We have seen dozens of scam broker websites that bear a striking resemblance to the one presented by these dealers, almost like clones created from a template. It leaves little room for doubt that, if there are any differences in content, they are likely minor. However, it’s essential to verify the information presented by the company and look for reviews about it online.

Legal Information and License

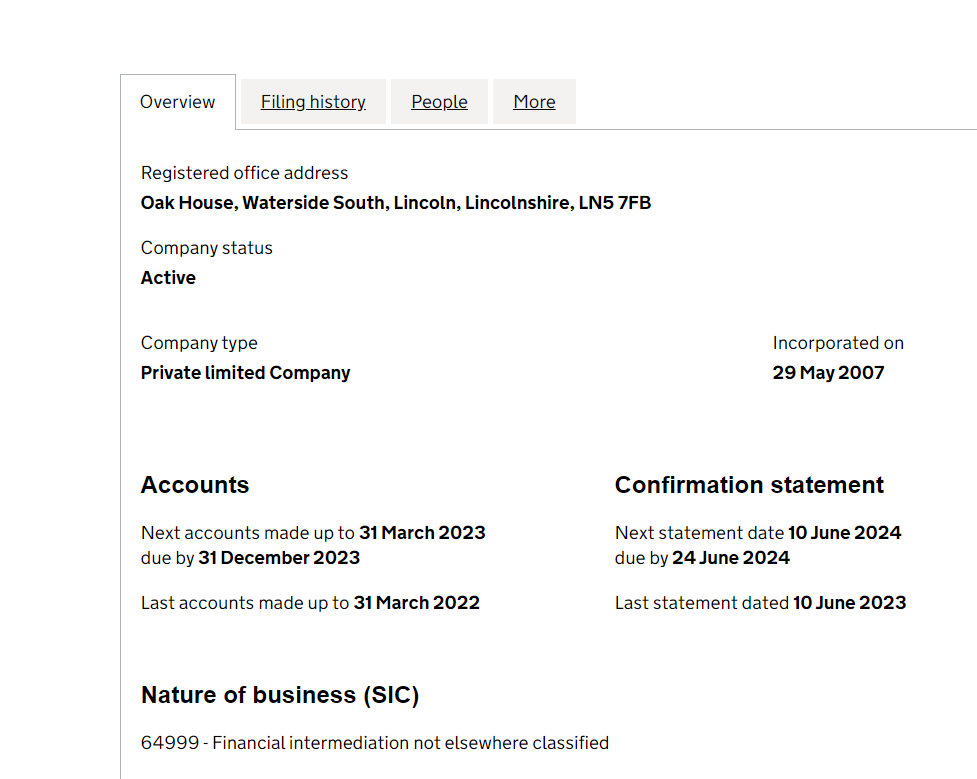

Legal information is specified in the footer. However, the company, Palmer Finance, is listed under the number 05305159 in the UK register. Apparently, the creators of the projects got lost in their legend.

Meanwhile, in the UK register we found a similar company. It was incorporated in 2007. Today, it is still operational and is involved in financial intermediation, not classified in other sections (SIC 64999). Perhaps this was the coincidence that the scammers from Lincoln Financial Service LTD were banking on. However, this rationale doesn’t hold.

Firstly, the legitimate company has its own website (https://www.lincolnfinancialservices.co.uk/), where it offers services related to pension planning, investments, insurance, including life insurance. In other words, the company operates as an investment advisor under a valid FCA license.

Secondly, more detailed information reveals that it’s not even in the same league as a broker, not even a starting one. Its net assets were slightly above £10,000, and its liabilities at the end of the 2022 financial year exceeded £25,000. Furthermore, the staff count is merely 1 person.

Drawing a conclusion is straightforward: the Lincoln Financial Service LTD project is not associated with any officially registered company. We would advise potential clients to think twice before transferring their money and consider who the recipient will be.

Lincolnfinancialservicesltd.vip Domain Info

The project claims that it was created by traders for traders, developing and providing clients with innovative, award-winning trading technologies. We openly state that these are empty words. Simply look at the timeline of this project.

According to whois data, the Lincoln Financial Service LTD domain was created on July 25, 2023. When this “broker” managed to develop “innovative, award-winning” technologies is a rhetorical question. However, the use of CloudFlare’s DNS servers is quite revealing. Based on our observations and feedback from experienced traders, scammers often employ this tactic to maximize data concealment.

This article has been updated. Now and again, scammers change their domains like horseshoes, hoping it will bring them happiness. As of March 2024, the current domain is: lincolnfinancialservicesltd.vip.

Contacts Review

The contact information provided by the company is quite perplexing. Lincoln Financial Service LTD is listed in the British registry, which suggests some form of connection to the United Kingdom. However, the company’s address is claimed to be in the United States, creating an inconsistency.

Adding to the confusion, the contact page displays phone numbers with a Polish area code. This multi-country affiliation raises serious questions about the company’s legitimacy and transparency. It’s not uncommon for fraudulent entities to use such tactics to obscure their true identities and locations. The combination of these factors makes it even more challenging to ascertain the true nature and whereabouts of this company.

Pros and Cons

- Multiple assets.

- Lack of regulation.

- Opaque account tiers.

- Poor trading platform.

- Questionable registration data.

- Unusual contact information.

Frequently Asked Questions (FAQ)

It claims to offer a range of trading services, including access to various assets and trading tools. However, due to concerns about its legitimacy and transparency, we advise caution when considering its offerings.

The minimum required deposit is $100, according to their trading conditions.

No, it cannot be considered a safe broker. It operates with questionable practices, including misrepresenting itself as a legal entity.

You will lose all the money you invested in Lincoln Financial Service LTD.

Transfer your money into Lincoln Financial, and you can be sure of one thing – you’ll lose your money. This, I guarantee, so to speak. This company is shady and fraudulent, providing a fake address and engaging in illegal activities. Stay far away from such a scam.

crap

All I found here were endless bonuses, huge leverage, and shady additional services – precisely what a fraudulent operation like Lincoln Financial Service LTD can offer. Frankly, I didn’t expect anything else. This company has absolutely no reputation, operates for just a few weeks, especially if you check the domain registration date (try it yourself). When I discovered that their email address doesn’t even exist – it’s fake, and the phone number simultaneously belongs to several other companies quite similar to this one, I understood everything. Scammers didn’t even bother to create a unique service; they hastily copied their old fraudulent websites, changing the name. That’s it. I’d like to believe that all their moves and attempts to swindle money from gullible people didn’t succeed and, on the contrary, not a single soul invested money here, leaving the fraudsters with the resources they spent on creating this scam.

Oszuści i złodzieje

Oszuści i naciągacze. Środki przelane na inwestycje nie do odzyskania. Złodzieje. Unikać LF Jak ognia i przekazywać informacje o nich dla następnych nieostrożnych i łatwowiernych klientach. Największy broker oszust to Olivier. Trzymaj się od niego z daleka