Many of our readers are interested in whether they can trust a particular platform for CFD trading and whether it is safe to collaborate with companies claiming to operate under regulatory oversight. In response to these inquiries, we have prepared a Nasesdubai.com review. In it, we examine whether the presented information about the so-called “International financial exchange in the Middle East” is reliable or if users are being lured into yet another scam. Want to get to the bottom of it? Read on — the information we’ve gathered will help you.

- Nasesdubai.com General Information

- Registration and Client Portal Review

- Account Types Review

- Trading Platform

- Nasesdubai.com — Deposit and Withdrawal of Funds

- Verification

- Additional Options

- Is Nasesdubai.com a Scam?

- Legal Information and License

- Capital Systematics Domain Info

- Contacts Review

- Pros and Cons

- Frequently Asked Questions (FAQ)

Nasesdubai.com General Information

| Website | https://nasesdubai.com/ |

| Phone Number | +16093888884 |

| support@nasesdubaius.com | |

| Address | Not specified |

| License | None |

| Minimum Deposit | Unspecified |

| Assets | CFDs |

| Leverage | Up to 1:1000 |

| Trading Platform | Native Webtrader |

Registration and Client Portal Review

We would love to say that the Nasesdubai.com website looks solid, as one would expect from the online resource of an organization named Nasdaq Dubai. Unfortunately, what we see is nothing more than a poor copy of a high-quality original — the website of the well-known broker IC Markets. The developers didn’t even bother changing the informational boxes — neither the layout, nor the names, nor the content. Even the color scheme of the pages has been copied. Meanwhile, the image scaling on the banner is laughable — take a look yourself and notice how the proportions of the central figure are distorted.

And that’s just the homepage. The rest of the website wasn’t given much thought either. Why bother when you can copy another well-known source — the broker Pepperstone? This applies both to the design, which is nearly devoid of images, and to the content. After all, why would traders care if they see a market holiday calendar for April 2023 or a photo of an analyst providing great reviews for a globally recognized broker? You might ask, does Nasesdubai.com have any original content at all? Practically none. In fact, we aren’t even sure if the trading conditions displayed on different pages — such as spreads and commissions — aren’t also copied.

Take note! That said, the website’s “talented” developers did manage to add something of their own — a completely inconvenient navigation system. None of the links on the pages can be opened in a new tab (right-clicking on links doesn’t work). Why create unnecessary obstacles for visitors? We have no idea.

Perhaps the only functional part of the site is the registration form. New clients can choose from three registration options:

- By phone.

- By email.

- Via an account on other services.

In the first two cases, users need to fill in just a few fields:

- Email address or phone number.

- Password (entered twice).

- Referral code (optional).

After that, they must request a verification code and enter it. The next steps involve filling in personal details, submitting verification documents, and selecting a trading mode. Creating an account is not difficult, though uploading documents may take additional time. Users can skip all steps except the first one and still have their account created.

This registration process seems oddly familiar to us — it closely resembles how things are done on centralized cryptocurrency exchanges. However, this platform claims to offer CFD trading and even some spot market assets. As far as we know, the account creation process for such platforms is usually different. But perhaps the company has its own interpretation of regulatory requirements.

For reference! It appears that the platform was originally intended to be a crypto exchange. At the very least, the Trading Center follows a typical crypto exchange template. Other indicators support this theory — for example, the verification email has the subject line: “[Exchange] code is: …”. The admins forgot to insert the exchange’s name in the settings, which no longer surprises us with this company.

Nasesdubai.com does not have a separate client portal (what we typically call a personal account). Instead, users are immediately directed to the Trading Center, which combines the trading terminal, profile management, and non-trading operations. However, the sheer number of non-trading functions makes it difficult for beginners to navigate.

In reality, it’s not as complicated as it seems. The numerous menu items related to profile and finance management exist only because of poor organization. For example, instead of a single unified account, the platform offers multiple wallets for trading different types of assets — which is hardly a good solution. This, too, seems to be a relic of a crypto exchange template. Otherwise, the overall functionality is not much different from what users expect in a standard client portal.

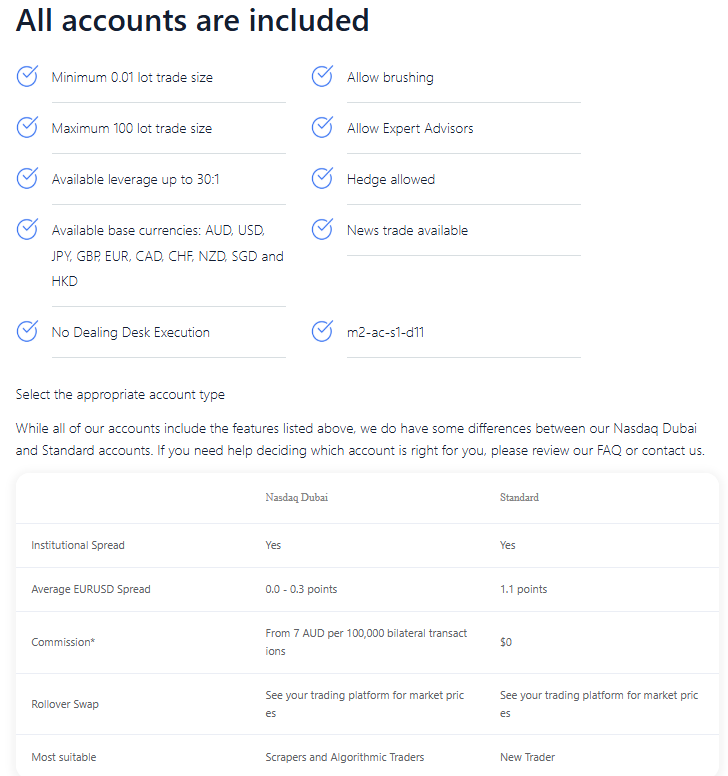

Account Types Review

The list of account types offered by Nasesdubai.com is not very extensive. It includes only two options:

- Nasdaq Dubai.

- Standard.

The first option, according to the broker, is best suited for algorithmic trading and offers tight spreads (EUR/USD 0.0-0.3 pips) with a commission of $7 per standard lot (full). The second option is easier for beginners to use. It has wider spreads (1.1 pips for EUR/USD) but no trading commissions.

Other conditions are identical for both accounts:

- Minimum trade volume of 0.01 standard lot, maximum of 100.

- Order execution method — NDD.

- Hedging (simultaneous opening of multiple positions on the same instrument) is available.

- Algorithmic trading is possible.

- Leverage up to 1:30.

More details on spreads and trading commissions were attempted to be presented by Nasesdubai.com on the “Spreads, swaps, and commissions” page. However, judging by its content, it turned out to be quite poor. While the minimum spreads starting from 0 pips match the claim, the trading commissions are presented very poorly. The company only provided commission rates for currency pairs, while fees for other asset classes remain undisclosed. Perhaps they are not as low as the broker claims.

It is also worth noting that the leverage information is unclear. On the homepage, we see a maximum level of 1:1000, in the account types table — 1:30, and in the terminal — only 1:10. Are the website developers unaware of what the company offers traders? Or should the numbers on its pages not be trusted at all, as they were never corrected after copying content?

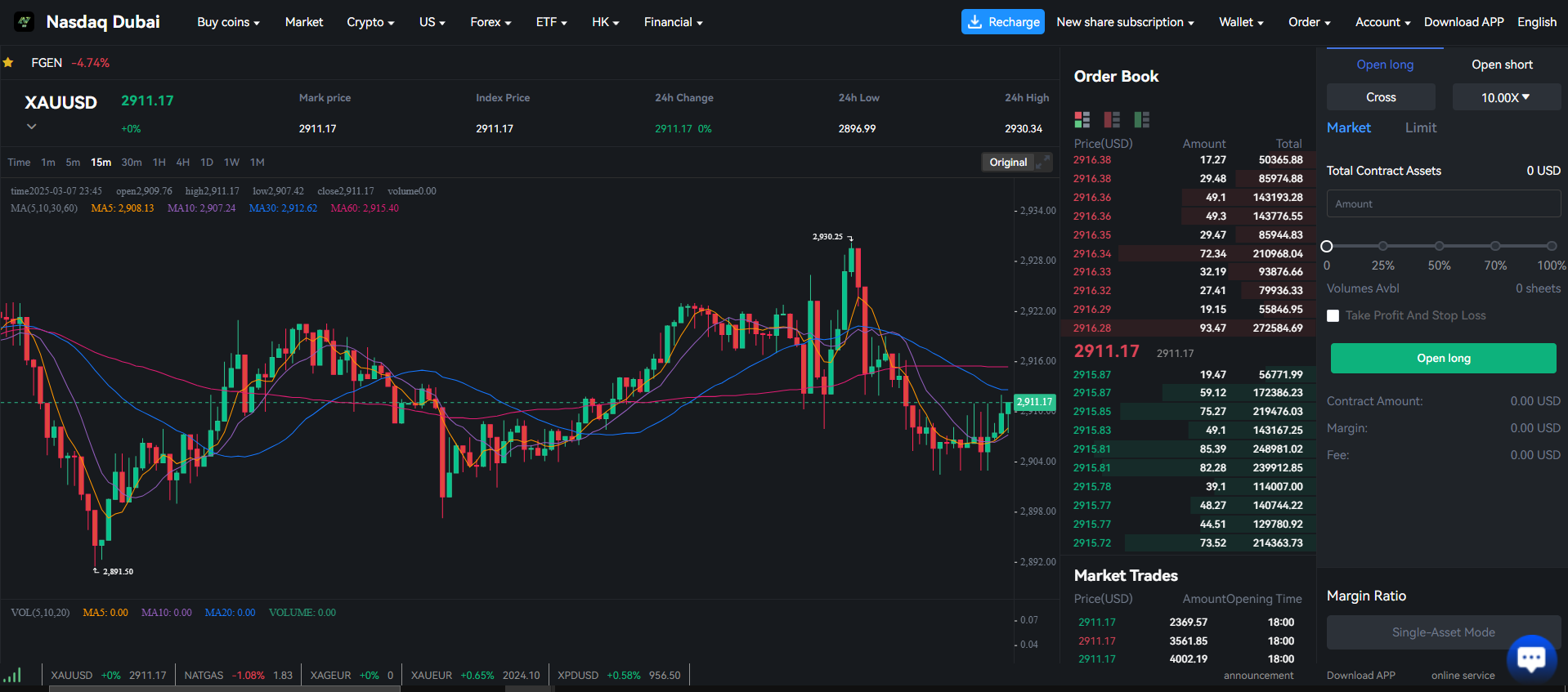

Trading Platform

The situation with Nasesdubai.com’s trading platforms is also very poor. On the homepage, the company states that it offers clients the best modern software — MetaTrader 4, MetaTrader 5, and cTrader. A separate page on the site is even dedicated to their description. However, there are no download links for either the desktop or mobile versions anywhere. After registering a new client, the Trading Center presents them with a web platform.

A similar setup can be found on cryptocurrency exchanges (as we have mentioned several times). However, comparing this web application with the software used by real exchanges does not favor the former.

It lacks:

- Multi-chart mode.

- One-click trading.

- A list of technical indicators beyond the ten most common ones.

- Any graphical analysis tools.

- Asset specifications.

In other words, the list of missing essential functions is very long. To summarize:

- It is impossible to trade properly with what Nasesdubai.com offers in the Trading Center, even for a professional with extensive experience.

- The modern trading platforms promised on the homepage are not available to clients.

- Automated trading is not an option since the system does not even support API functionality.

It is clear that the broker primarily targets inexperienced beginners who have not yet encountered high-quality trading software. However, such blatant disregard for clients’ interests and deception is something we have rarely seen before.

Nasesdubai.com — Deposit and Withdrawal of Funds

The company uses only two payment methods for deposits and withdrawals:

- Debit/credit bank cards.

- USDT stablecoins.

In the first case, the user needs to enter their card details in their profile and verify its ownership and availability (by sending a photo). In the second case, transactions can be carried out even without entering personal data. The only requirement for the user is to confirm the transfer of funds.

In both cases, the recipient’s details remain unknown. The broker clearly does not want to disclose its financial transactions to tax and regulatory authorities. The fact that such payment methods violate the AML Policy does not seem to concern them, especially since the company does not have such a document. Some of its provisions are outlined in the Terms & Conditions, but the key word in that section is “sometimes.”

Verification

Nasesdubai.com requests verification when a new client registers. However, this step can be skipped, allowing users to start working anonymously. Verification is only mandatory when submitting a withdrawal request; otherwise, the request will not be processed.

The company’s requirements are completely standard. Users will need to send copies of:

- A passport or National ID.

- A bank statement or utility bill.

- A bank card (photos of both sides).

Additional Options

In the Trading Center, Nasesdubai.com offers various additional options. Judging by the trading menu, clients can not only trade CFDs but also buy real securities (stocks and ETFs) and exchange currencies.

It is worth noting that in the case of stocks, there is not even a hint of depository services, without which asset storage is impossible. At the same time, the number of available instruments for all operations, including trading, is so limited that working with this broker seems completely unappealing. For example, what kind of trading in U.S. stocks can be considered if the list does not include market leaders such as Apple, Google, NVIDIA, Microsoft, or Tesla?

Note! We checked several tickers under “U.S. Stocks” and found that they belong to small-cap companies. The question is, does the company plan to manipulate the market itself, or will it wait until its clients lose money in another pump & dump scheme?

Is Nasesdubai.com a Scam?

Everything mentioned above does not align with a company operating under a legitimate license. Now, we need to check the official details of this project to make a final conclusion.

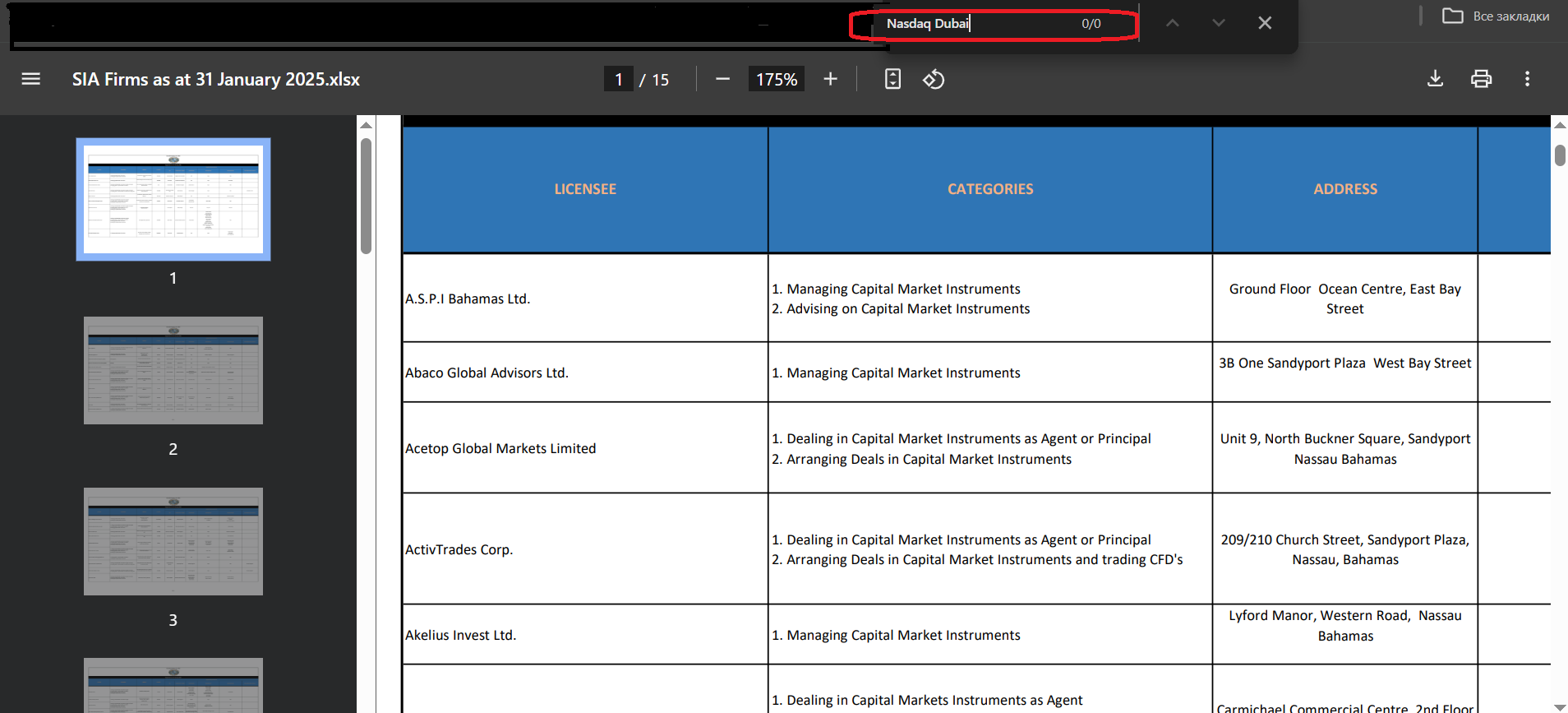

Legal Information and License

Let’s start with the name. Nasdaq Dubai is a real entity and is an exchange operating in the UAE. Interestingly, the “Why Nasdaq Dubai?” section on Nasesdubai.com is entirely copied from its official website.

Several facts indicate that Nasdaq Dubai Markets Limited (as the entity in our review calls itself) has no connection to the real exchange:

- The exchange has its own official website: https://www.nasdaqdubai.com/.

- The exchange’s documents do not mention the company name at all. The real entity is known as Nasdaq Dubai Ltd.

- The exchange is registered in the UAE, licensed, and regulated by the Dubai Financial Services Authority (DIFC).

Now, what do we see with Nasesdubai.com? The company claims to be registered in the Bahamas and even holds a license from a local regulator. A check of the Bahamas business registry does not show a company named Nasdaq Dubai Markets Limited. The firm does not have a license from the Securities Commission of the Bahamas.

However, we found out who actually owns the license number provided by this broker. Can you guess? Yes, you’re absolutely right — it belongs to Pepperstone.

Thus, we are dealing with a fraudulent company that attempts to pass itself off as a legitimate exchange and steal funds from inexperienced investors who cannot detect the deception. The registration and licensing information provided by the broker is false. The so-called broker is not registered anywhere, does not work with even offshore regulators, and operates illegally.

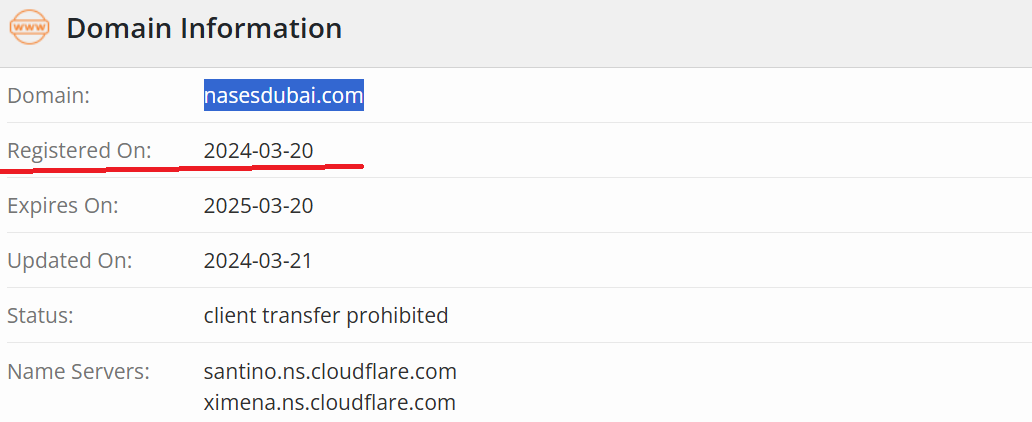

Capital Systematics Domain Info

To determine the real start date of this fraudulent company’s online presence, we turn to WHOIS data for domain registration details.

The Nasesdubai.com domain was registered on March 20, 2024. Web archive snapshots confirm that this fake firm has been active for almost a year. It is evident that many newcomers have fallen for this scam, mistaking it for a real exchange. Fraudsters have likely already stolen substantial amounts but continue operating. It will be interesting to see whether they renew the domain registration, which expires in March.

Contacts Review

The Contact Us page on Nasesdubai.com is probably the most minimalistic section of the entire website. This is not a criticism — just a fact: the page contains nothing but an email address, which is repeated twice. We also found a phone number, but only in the Terms & Conditions.

The scammers do not provide any other contact details. After all, how can a non-existent company have a physical address? And why would they maintain social media accounts when they couldn’t even come up with a proper design and content for their own website?

Pros and Cons

- No minimum deposit restrictions.

- Spreads on the most liquid assets start from 0.0 pips.

- The broker uses the name of an existing exchange to attract inexperienced traders.

- The platform operates without official registration, provides only virtual services, and imitates trading.

- A non-existent company cannot have licenses, and its entire operation is illegal.

- Information published on the website is false and copied from other brokers.

- Even the trading conditions contain numerous contradictions.

Frequently Asked Questions (FAQ)

The scammers claim to offer CFD trading and some spot assets. However, no information from this fake company can be trusted.

The owners do not set a minimum deposit, only requiring an amount that allows you to open and maintain a position. However, we wouldn’t deposit even a few cents here — supporting scammers is never a good idea.

This fake company doesn’t even have a proper website. So, what kind of security measures can they possibly offer? Well, in one way, it is “safe” — because once your money is stolen, nothing will ever threaten it again.

A failed first experience

This was my first experience in financial markets. And unfortunately, I stumbled upon Nasesdubai.com.Actually, they found me first -telling me all about how easy it is to make money on their “exchange” if I invested enough and followed my “personal manager’s” advice.The result? $20,000 lost. Stress. Fear of trading ever again. I wouldn’t wish this experience on anyone!