Enter the shadowy world of Squire’s Finance Limited, a broker that claims to cater to both retail and institutional investors. However, behind their enticing facade lies a potential scam. Read our review, and you’ll discover a chorus of disgruntled voices recounting tales of shattered dreams and lost investments.

- Squire’s Finance Limited General Information

- Registration and Client Portal Review

- Squire’s Finance Limited Trading Conditions

- Account Types Review

- Trading Platform

- Squire’s Finance Limited — Deposit and Withdrawal of Funds

- Verification

- Additional Options

- Is Squire’s Finance Limited a Scam?

- Legal Information and License

- Squiresfinanceltd.com Domain Info

- Contacts Review

- More Details

- Pros and Cons

- Frequently Asked Questions (FAQ)

Squire’s Finance Limited General Information

| Website | https://www.squiresfinanceltd.com/ |

| Phone Number | +442080977710 |

| support@squiresfinancelimited.net | |

| Address | 20 Farringdon St, London EC4A 4BL |

| License | — |

| Minimum Deposit | €250 |

| Assets | CFDs |

| Leverage | Up to 1:1000 |

| Trading Platform | WebTrader |

Registration and Client Portal Review

The most notable aspect of Squire’s Finance Limited’s website is its color scheme. The creators have curated a pleasant palette that catches the eye. However, beyond this visual appeal, the website falls into typical templates. Here, you will encounter numerous empty claims of being crafted by seasoned traders and promising to serve retail traders with the same level of service as institutional investors. Additionally, you will find the obligatory disclaimer and a sprinkle of legal information in the footer.

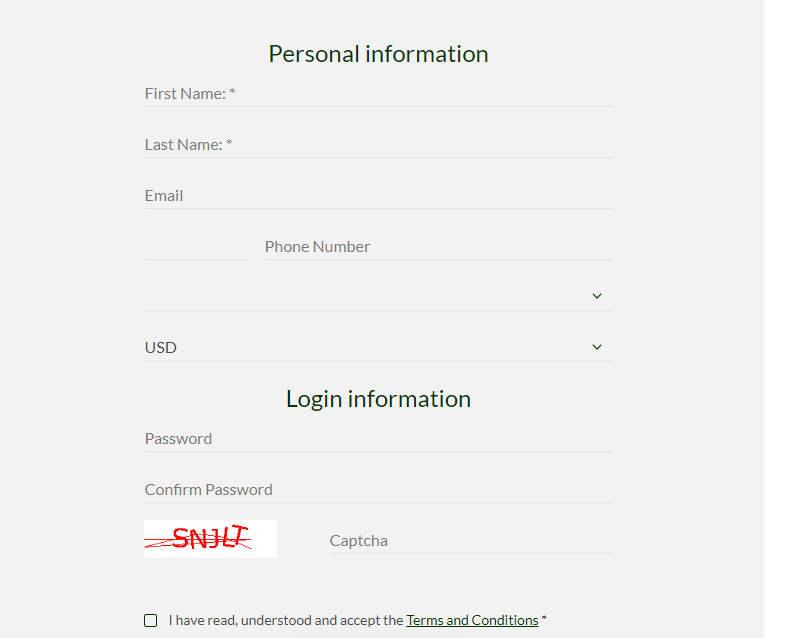

The registration process at Squire’s Finance Limited follows a standard procedure, albeit with a significant drawback. One of the concerning aspects is that the broker does not verify the provided information, such as email or phone number. This lack of verification raises concerns about the security and legitimacy of the platform. Without proper authentication measures in place, it becomes easier for potential scammers to put users’ personal and financial information at risk.

Once registered, traders are directed to the typical Client Portal at Squire’s Finance Limited, which, unfortunately, fails to meet expectations. It follows a generic template that lacks innovation and user-friendly features. Navigating through the portal feels like a tedious and uninspiring task, with limited options for customization or personalization.

Squire’s Finance Limited Trading Conditions

We are already very curious to explore the exclusive trading conditions offered to private investors by Squire’s Finance Limited.

Account Types Review

The broker offers a total of five account types, distinguished by their minimum deposit requirements and certain trading conditions, such as leverage. For instance, the Test account requires a minimum deposit of 250 euros and only allows trading in currency pairs. Moving on to the Novice account, which necessitates a deposit of 2,000 euros, traders gain access not only to currency pairs but also to indices. Moreover, the Novice account offers an increased leverage of up to 1:300.

It’s interesting to note that the next account, Standard, demands a significantly higher deposit of 50,000 euros, which deviates from standard industry practice. As an additional benefit, traders with a Standard account are granted the ability to trade commodities. The Corporate and VIP accounts require deposits of 150,000 euros, granting access to all available assets and significantly higher leverage ratios of 1:500 and 1:1000, respectively. These are essentially all the advantages offered. It’s quite peculiar that the broker has set such inflated minimum deposit requirements for these accounts.

Trading Platform

Squire’s Finance Limited falls short in several aspects. The platform lacks essential features, provides a subpar user experience, and offers limited educational resources. Besides, disappointingly, there is no demo account available for users to practice trading. It’s important to exercise caution when dealing with this broker, as this terminal has been associated with fraudulent activities in the past.

Squire’s Finance Limited — Deposit and Withdrawal of Funds

Squire’s Finance Limited offers multiple deposit methods, including credit and debit cards, P2P, cryptocurrencies, and bank transfers. The same methods are available for withdrawals. However, the broker fails to provide information regarding fees and processing times, leaving users uncertain about the associated costs and the timeframe for transaction processing.

Verification

The standard verification process at Squire’s Finance Limited involves several steps to ensure compliance and security. The broker may request identification documents, including a valid passport or driver’s license, as well as proof of address, such as a utility bill or bank statement. Once the required documents are submitted through the designated channels, the broker’s verification team reviews, and verifies the information provided.

Additional Options

Squire’s Finance Limited offers a partner program where users can build a network of affiliates or receive CPA (Cost Per Acquisition) rewards. However, the exact reward structure and commission rates are not specified, leaving potential partners in the dark about the earnings they can expect.

Furthermore, the company advertises a 45% bonus on the first deposit. While this may initially seem enticing, it is important to note that such bonuses often come with stringent terms and conditions. These terms may include high trading volume requirements or limitations on withdrawal until certain criteria are met.

Is Squire’s Finance Limited a Scam?

We haven’t found Squire’s Finance Limited to be an appealing broker. While we acknowledge the possibility of bias, our experience has shown that brokers with similar trading conditions often turn out to be ordinary scammers.

Legal Information and License

In the footer of their website, Squire’s Finance Limited provides legal information claiming to be a British company. However, we regret to inform you that these scammers have no association with the actual firm. The original Squire’s Finance Limited is a small family company that was established back in 1986. If this were a legitimate broker, they would need advertising. However, there are only a couple of recent reviews about this project online. What kind of broker doesn’t need clients or advertising?

Furthermore, although Squire’s Finance Limited is authorized in the FCA register, it is not a brokerage service. The company is not allowed to hold or control client funds. Instead, they assist users with insurance matters and engage in credit broking.

Squiresfinanceltd.com Domain Info

As mentioned earlier, Squire’s Finance Limited claims to have been founded in 1986. However, this date holds no relevance to the actual operations of the broker. According to the Whois service, the website was created on April 24, 2023.

Contacts Review

Squire’s Finance Limited offers multiple contact methods, including phone and email. They also provide an address on their website, but rest assured, there won’t be any managers awaiting you with open arms. Since the company is fake, they do not have a physical office either.

More Details

The most apparent evidence that Squire’s Finance Limited is a scam is the pattern of their projects. This is not the first “broker” from these creators. For instance, in the “Partnership” section, you may even notice that they didn’t bother to change the name. In this paragraph, they refer to an old project by these scammers called Medco Finance Limited, which was also a pseudo-English company. The number of their projects is countless. For example, one of their recent projects is Nelson Financial Solutions Limited. You can observe several distinct similarities, such as similar narratives, identical trading platforms, and more.

Pros and Cons

- None.

- Fake legal data

- Lack of license

- No official registration

- The short period of work

- Scam line of pseudo-brokers.

Frequently Asked Questions (FAQ)

Squire’s Finance Limited offers you to trade CFD on financial markets.

The minimum deposit according to the broker’s trading conditions is 250 euros.

No, it’s not safe. Squire’s Finance Limited is just pretending to be a real company. In fact, it has no rights to provide brokerage services.

I didn’t see any positives at all, how is this possible?

It’s sheer idiocy, pardon my language, to increase the leverage as deposit size grows. What’s the point of offering a 1:1,000 leverage on the VIP plan, where the minimum deposit is 150,000, but only providing a 1:200 leverage on the small plan with a deposit of 250 euros? What’s the catch? For a trader with 150,000, the maximum leverage should be 1:10, not 1:1,000. Who came up with such trading conditions? Have they ever traded in forex? And what’s with these limitations on available assets? Why can’t I trade stocks or crypto on the first account type? I’ve never encountered such terrible and irrational conditions anywhere. Squire’s Finance Limited is a seriously shady company.

They are scammers who steal money

Under no circumstances would I trade in this place. Firstly, Squire’s Finance Limited is completely unregulated, which means traders’ interests and funds are not protected. The broker can scam you at any time, and you won’t be able to do anything about it. Secondly, there is no fund insurance. It’s similar to the first point. Thirdly, it’s a B-Book model, which means a conflict of interest between the broker and the trader. Do you want me to keep listing the drawbacks of this forex scam or is that enough for you?

UK address provided by Squire's Finance Limited is fake, and the company had been blacklisted by regulatory authorities.

I want to share my experience with Squire’s Finance Limited, a financial firm I joined a few months ago. Initially, I invested 25,000 euros with them, and after doubling my money, I decided to add another 40,000 euros to my investment. It all seemed promising, and my investment officer, Tyler Cameron, was actively assisting me with making trades.

For a while, things appeared to be going well, and our investments managed to accumulate over 150,000 euros in profits. However, my experience took a drastic turn when I decided to request a withdrawal. To my surprise, it has been over two weeks, and my request remains unapproved.

I reached out to the company for an explanation, and what I was told left me deeply concerned. They informed me that, as per their company policy, I would need to deposit an additional 22,000 euros upfront to cover a 13% withholding tax. This demand raised numerous red flags, and I began to question the legitimacy of the entire operation.

scam

Hi Manon,

I have same experience with this company. Please contact me regarding discussing options for recovery.

Scam

Hello! I invested in the Squires Finance company around €10000 how can I get it back?

Greg

Hi Manon,

I would like to know more about how I can recover my funds Squires stole from me. Thanks

for Boris

Hi Boris what options are there?funds. I tried Woodrow but they are demanding upfront money to release my

Fake

There is indeed a company called Squire’s Finance Limited in England. However, it is an entirely different company that operates offline and doesn’t have an official website. This broker is a pathetic imitation using someone else’s name. Even their office addresses are different. The scammer’s domain appeared just last month.

fraud only be advised

this is a scam. i lost 18,000 euros from tyler cameron the ****head crook. a pending investigation is ongoing. anybody who wants his passeport to put a contrat on colleection to contact me.

is that is real name??

if i could put 0 stars, he is a proffesional fraudster.

Where is he

Any contact details or proof of who he is will be greatly appreciated

Scammers without a doubt

The dealer is English speaking with a midlands accent, They scammed me out of a £30000 investment and 30000 profit, even tried to steal 3000 from my daughter, because I had no money left. Anybody know where I can chase them?